This blog post looks at tourism spending across New Zealand’s regions to establish how the tourism sector recovery is going since borders reopened. The findings of which regions have more visitor spending than before Covid-19 may surprise you.

Recently released data from the MBIE showed that tourism spending across New Zealand in the September 2023 year was sitting at 100% (99.7%) of its pre-Covid level, with domestic visitor spending sitting at 116% of where it had been pre-pandemic, while international visitor spending was at 76% of pre-pandemic levels. Although the MBIE visitor spending data doesn’t account for inflation or squeezed profit margins, it at least gives a barometer for how topline spending is tracking.

Cumulatively over the past year, international visitors have spent $9.3 billion across New Zealand, while domestic travellers have spent $20.7 billion across the country. To put the $9.3 billion of international visitor spending over the September 2023 year in perspective, that makes tourism our second biggest export earner behind dairy ($20.3 billion of exports), but ahead of meat ($8.7 billion), forestry ($4.8 billion), and fruit ($3.7 billion).

With the tourism recovery in full flight, and expectations high of a bumper summer season off the back of a surge in long-haul flight capacity, the question is whether these spoils are being evenly spread?

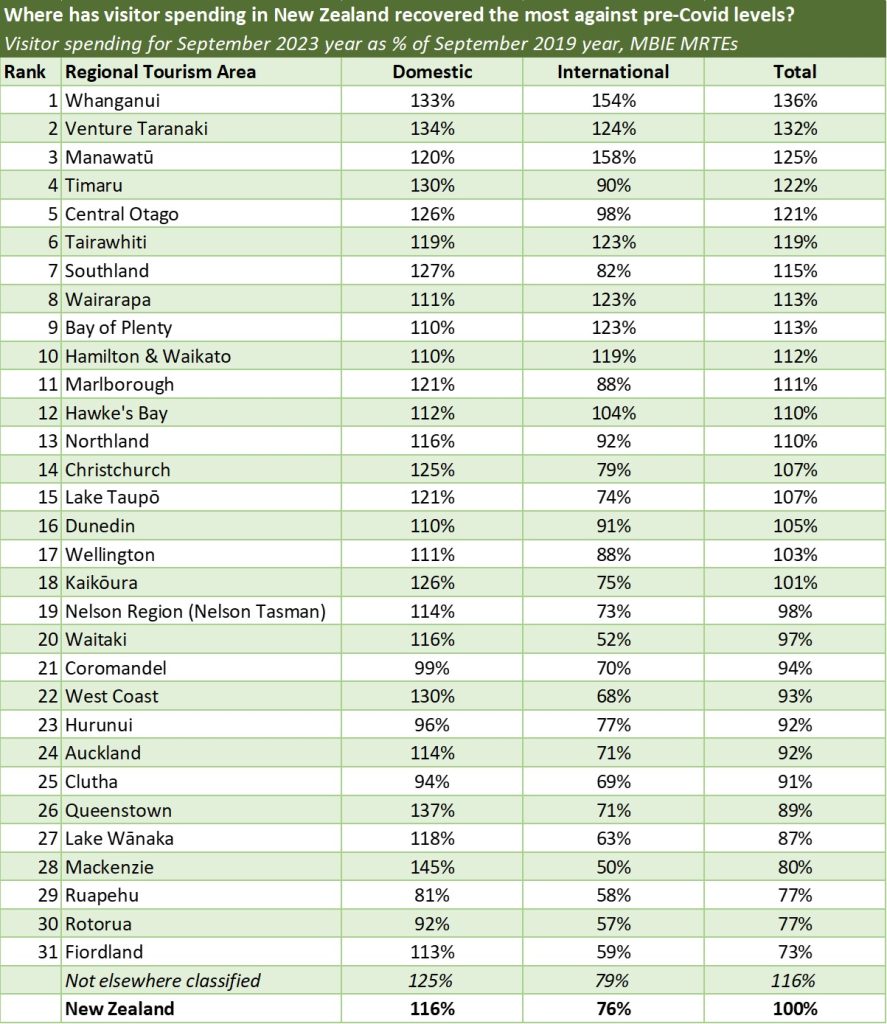

The following table shows how visitor spending in of New Zealand’s regional tourism areas sat over the September 2023 year, compared to the September 2019 year before Covid-19.

Of New Zealand’s 31 regional tourism organisations, 18 have visitor spending which is above pre-pandemic levels, with 13 still sitting below their pre-pandemic level.

Places above pre-Covid levels are not where you would think

Heading the list are Whanganui, Taranaki, Manawatū, Timaru, and Central Otago. This list of top performers may surprise many, as not all of these areas are traditionally associated with tourism. But what they all have in common is that they are dominated by domestic tourism (see the table below) which has in all cases soared over recent years into these areas. The reality is that kiwis fell back in love with their own backyard during Covid, and for the most part that love affection is remaining!

Key destinations for international visitors still have some recovery to go

At the bottom of the list for the post-Covid recovery are some of New Zealand’s most iconic tourism destinations, including Fiordland, Rotorua, Ruapehu, Mackenzie, Wānaka, and Queenstown. Many of you may be surprised to see such popular destinations appearing to lag, but what they all have in common (apart from Ruapehu) is that these places have a much higher reliance on international visitors than the national average. For example, international tourists represent about 31% of visitor spending nationally, while in places like Fiordland and Queenstown this proportion approaches 60%. The reality is that no matter how fast international visitor spending grows, it just takes a wee bit of time to go from effectively $0 during 2021 to places like Queenstown now earning $1.3 billion a year again from international visitors.

The gap will close further this summer

As we look towards the summer season, I am optimistic than many of these key destinations will close their gaps back to pre-Covid spending by international visitors. Flight capacity this summer for most markets has now recovered to close to its 2019 pre-Covid peak levels. Furthermore, the influential North American market has record capacity now coming into New Zealand, with new flight routes opening up direct to Christchurch, and Auckland Airport forecasting almost 30% more seats in Summer 2023/24 compared to pre-Covid.